Funding

Disparity and Opportunity:

The funding historical data reveals a 2.5X difference in total aggregate number of US funded deals versus EU deals. The base average of capital raise per deal in the US is $9.3M, with a median new money amount of $5.0M. The same ratio for EU deals is $4.8M, and a median new money amount of $2.6M. The median pre-money value for a US deal was $13.5M. (Source) It’s clear there is an undersupply of funding to early stage deals in the Nexus region, and, those deals being funded are hypothesized as being under funded as well.

The disparity supports the empirical observation that EU Nexus-located deals are facing a “valley of death,” in that many are successful in obtaining angel and/or seed funding, but then many fail upon entering the valley, the point at which institutional VC must be raised. The small handfuls of investment firms in this region are less focused on early stage capital, they represent more of a private equity approach to the early stage needs: applying a wrong model to the true investment startup thesis. This has exacerbated the valley of death, and misrepresented the reality of the innovation occurring in the region. It has generated a self fulfilling prophecy on EU Nexus-located deals. The US/Silicon Valley perception that “deal quality” in the EU is “not as good,” the ideas are not there, there are not enough people, the EU governance structures inhibit entrepreneurialism, less advantageous tax structures, etc. A thorough research of the facts reveals different conclusions. A vibrant tech/entrepreneur ecosystem is growing rapidly with Amsterdam as its Nexus locale.

The data supports a view that (a) there is ample demand in terms of startups on the scene, (b) there is too little supply in terms of professional grade US-style VC firms and too little cash, and (c) when the cash is invested it is perhaps underfunding the deals, at a higher degree of dilution to founders than that found in the US. This last point is in fact a demoralizing factor for founders as well.

There is most certainly an undersupply of venture capital for the target EU Nexus environment, whereas the US scene represents an oversupply. This phenomenon is hypothesized as a relative atrophy in the US VC community, where the top 20% of the firms garner 80% or more of the quality deals, and, due to this skew, there is no emphasis on non-US, and more specifically, non Silicon Valley deals.

The Project Nexus view on this is simple. This new EU Nexus entrepreneur ecosystem lacks a US-style venture approach. This is cultural in a sense, reflecting the relative perceived lower risk threshold of EU investors, and, the US style of being essentially less international in reach.

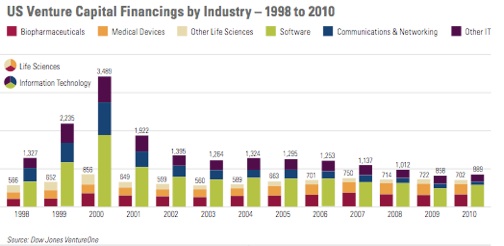

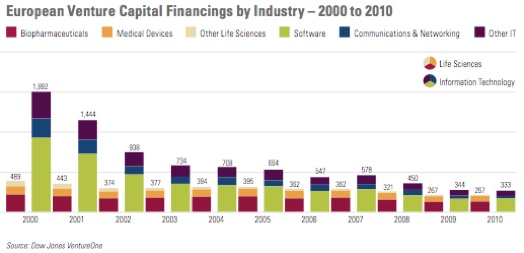

A summary and comparison of fairly recent (2010) venture deals in the US versus the EU follows:

US/EU Financings:

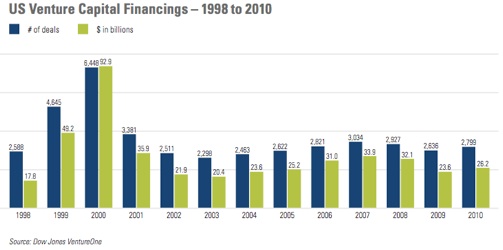

In 2010, 2,799 reported venture capital financings raised total proceeds of $26.2 billion, compared to the 2,636 financings that raised $23.6 billion in 2009.

Seed and first-round venture capital financings represented 35% of the total number of venture financings in 2010 (compared to 33% in 2009) and 17% of the total amount of venture capital investment (compared to 18% in 2009). Seed and first-round financings have constituted between 29% and 41% of the total number of all venture financings in each year since 2001.

US/EU Deals:

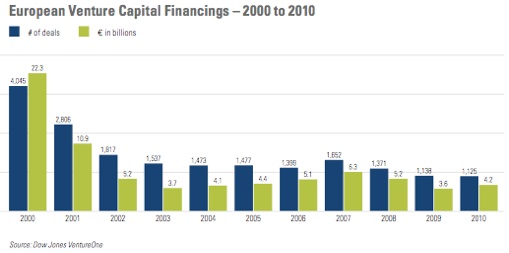

Venture capital financing proceeds in Europe increased to €4.2 billion in 2010 from €3.6 billion in 2009, while the number of financings was essentially flat—1,125 in 2010 compared to 1,138 in 2009. The median financing size in Europe increased from €1.6 million in 2009 to €2.0 million in 2010

Valuations- Q1 2012 Data

US Companies that raised money in Series A venture financings in Q1 2012 did so at valuations significantly higher than those in Q3-Q4 2011. The median pre-money valuation for Q1 2012 Series A rounds (other than angel deals) was $9.2 million, compared with $8.0 million in Q4 2011 and $5.6 million in Q3 2011. For companies raising funds in Series B rounds, the median Q1 2012 valuation rose to $15.0 million from $12.3 million in Q4, although both of those figures were lower than the $18.0 million median Series B pre- money valuation in Q3 2011. For companies raising funds in Series C and later rounds, the median pre-money valuation in Q1 2012 essentially stayed flat at $75.0 million, compared with $75.8 million in Q4 2011. Valuations in later-stage transactions showed more stability on average, but diverged by industry, with lower valuations in clean technology and life sciences, but increasing valuations in software as well as media and information services. (Source)

Copyright 2010-2013 by Shamrock Ventures, B.V. All Rights Reserved